Let's be honest, in the fast-paced world of healthcare, staying financially healthy is as vital as keeping patients healthy. This means plugging the holes where precious revenue might be slipping away. The is to find effective ways to stop revenue leakage in healthcare.

This challenge is a widespread concern in healthcare. Unfortunately, many healthcare organizations are unaware of the true extent of their losses. In this blog, we'll take a look at some of the most common reasons for revenue leakage and ways you can stop it.

Understanding Revenue Leakage in Healthcare

Revenue leakage in healthcare refers to the difference between a provider's potential revenue and their collected revenue. It's not about one massive loss, but rather a slow, often unnoticed, trickle of income disappearing through numerous cracks in the system.

Each of these "cracks," ranging from medical billing issues and claim denials to poor patient experience, requires unique solutions. Understanding what causes revenue leakage is crucial to addressing it.

As a healthcare organization, recognizing the multifaceted nature of revenue leakage is your first step towards financial stability. Issues such as inaccurate coding and billing or unresolved claims can swiftly eat into your profits. For instance, unrepresented ICD-10 codes or incorrect patient information entry can disrupt your revenue flow significantly.

Furthermore, areas like missed patient collections, ineffective insurance registration, and payor-provider agreement errors add layers of complexity. All these challenges can affect the precision of your financial reporting and the overall fiscal health of your institution.

To effectively tackle these issues, you must equip your organization with the necessary tools and knowledge. This requires engaging in regular reviews, implementing robust systems, and fostering a culture of vigilance to prevent revenue from slipping through unnoticed gaps. By prioritizing these efforts, you can turn potential financial losses into opportunities for growth and resilience.

What Causes of Revenue Leakage in Healthcare?

Many factors contribute to this persistent problem, but some consistently stand out.

1. Inaccurate coding and billing are major culprits.

In the complex world of medical codes and billing practices, even a slight error can lead to claim denials or underpayments from insurers. The risk of coding errors and billing issues increases with the volume of patients served, especially for practices relying on manual data entry.

Editor's Note: Many of the errors that occur during registration or eligibility verification are due to data entry mistakes. Many companies in the healthcare industry like United Healthcare are turning to Magical to help with these errors.

Magical is an automation and productivity tool that eliminates repetitive typing tasks like patient registration and transferring patient data between systems. You can set up automations with Magical to autofill forms, thereby reducing errors.

2. Claims denials pose another significant challenge.

A 2020 Change Healthcare Revenue Cycle Index report revealed that over 11% of claims were denied upon initial submission. Even with a dedicated staff diligently managing denials, a significant portion remains unresolved, leading to significant revenue loss for healthcare facilities.

3. Complex insurance rules and regulations.

The intricate web of insurance rules and regulations further complicates the issue. Studies reveal that many healthcare providers consistently receive underpayments from insurers, ranging from 7% to a staggering 11%. Sadly, these underpayments often go unnoticed, leaving providers inadequately compensated for the care they provide.

4. The heavy impact of patient collections.

The burden of patient collections also heavily impacts providers. High-deductible plans and rising out-of-pocket costs leave patients with increased financial responsibility for their healthcare. This scenario can lead to an increase in patient payment issues, bad debt, and further lost revenue for healthcare providers.

Cause of Revenue Leakage Impact Example Inaccurate coding and billing Claim denials, underpayments Incorrectly coding a surgical procedure. Claim denials Lost revenue, increased administrative costs Missing prior authorization for a test. Underpayments from insurers Reduced reimbursements, financial strain Insurer paying less than the contracted rate for a service. Missed patient collections Increased bad debt, cash flow problems Patient unable to pay a large deductible.

Statistics show that over 40% of healthcare organizations lose at least 10% of their annual revenue to leakage. Additionally, a concerning 23% are completely unaware of how much revenue they are losing. It's a significant drain on resources that can jeopardize a provider's ability to invest in new technologies, hire needed staff, and deliver optimal patient care.

Impact of the COVID-19 Pandemic

The COVID-19 pandemic significantly impacted revenue leakage in healthcare. The ripple effects went beyond the direct costs of treating COVID-19 patients. It also significantly changed patient behavior.

Many people delayed or avoided routine healthcare visits due to fear of infection. This drop in patient volume resulted in a drastic decline in providers' income.

Research indicates that private physicians in the US faced an estimated $158.35 billion revenue loss from the start of the pandemic until mid-2021. This lost revenue had serious repercussions for healthcare providers already operating on thin margins.

Providers struggled to cover operational expenses while dealing with a fluctuating payer mix. Data from the Medical Group Management Association (MGMA) highlights the impact on medical groups' payer composition, illustrating how healthcare organizations navigated this turbulent financial period. The financial distress also affected patients.

Deferred treatment often led to a worsening of pre-existing conditions. This delay resulted in a greater need for intensive and expensive care later on, putting a strain on both payers and patients' finances.

Battling Revenue Leakage in a Shifting Landscape

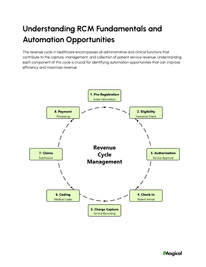

As the healthcare industry recovers and evolves, addressing revenue leakage is an ongoing challenge. One crucial area of focus is optimizing revenue cycle management (RCM). RCM encompasses the interconnected processes from patient appointment scheduling to payment collection.

Making the steps in the RCM cycle as efficient and streamlined as possible is key to minimizing revenue leaks. This optimization involves several steps, including improving initial processes and tackling bottlenecks that occur toward the end of the cycle. Healthcare providers need to stay vigilant and adapt to the ever-changing healthcare landscape to successfully combat revenue leakage.

One of the most effective ways to achieve this is by harnessing the power of technology. Automated solutions and advanced analytics can offer invaluable insights into your RCM cycle, helping you to identify areas where leaks are most likely to occur. By integrating artificial intelligence and machine learning algorithms, healthcare organizations can predict potential disruptions and swiftly address them, ensuring the revenue stream remains uninterrupted.

Moreover, keeping abreast of regulatory changes and compliance requirements is crucial. This not only safeguards against potential fines and penalties but also ensures that your processes are up-to-date with the latest industry standards. Compliance management tools can aid in monitoring changes proactively, thus reducing the risk of revenue loss.

Creating a cross-departmental task force dedicated to overseeing and coordinating RCM activities can also greatly impact the organization's ability to fight revenue leaks. Such teams are not only focused on immediate fixes but also engage in strategic planning to anticipate future challenges. Collaboration fosters an environment where improvements are continuously implemented, and feedback is rapidly acted upon to enhance overall financial performance.

Ultimately, success in revenue cycle management hinges not only on having the right tools but also on integrating them effectively into your operations. A proactive and informed approach can empower your organization to maintain financial health, sustain growth, and thrive in an increasingly competitive market.

Using Tools to Address Revenue Leakage

Addressing revenue leakage in healthcare requires more than just acknowledging it; it demands the deployment of effective tools and strategies that target the root causes of the problem. Leveraging technology and data analytics can empower you to tackle these challenges head-on.

Big Data Analytics: Utilize big data analytics to uncover patterns of revenue leakage that might elude the naked eye. By processing vast amounts of data, you can pinpoint inefficiencies or discrepancies in billing and collections. This insight allows for more precise adjustments and informed decision-making.

Optimized Revenue Cycle Management (RCM): The heart of addressing revenue leakage lies in optimizing RCM processes. Implement software solutions that streamline administrative tasks, ensuring claims are filed correctly and timely. These systems can minimize errors that often lead to leakage, such as miscoded procedures or overlooked charges.

Regular Revenue Leakage Audits: Create a comprehensive checklist for audits focused on identifying areas prone to revenue leakage. By systematically reviewing billing processes, contractual obligations, and compliance with payer regulations, you can uncover hidden discrepancies that might otherwise go unnoticed.

Effective use of these tools not only aids in addressing current leakage but also acts as a preventative measure. Staying proactive with cutting-edge technology and rigorous audits is vital to safeguarding your organization's financial health. Remember, a vigilant approach to monitoring and adjusting your strategies as necessary is crucial to combating revenue leakage. The ultimate aim is to ensure long-term sustainability and robust financial performance by constantly refining the systems in place.

Plugging the Holes: Strategies to Prevent Revenue Leakage

Healthcare organizations can significantly improve their financial health by proactively identifying and addressing potential sources of revenue loss. Implementing solutions before leaks occur is more effective than reacting after the damage is done.

This approach means establishing systems and leveraging technologies designed to identify and minimize these leaks. This strategy ultimately frees up resources to invest in better patient care and innovation.

While navigating this process might seem like a lot, it can be broken down into achievable steps. Below are proven strategies to minimize revenue leakage in healthcare.

1. Implement a comprehensive electronic health record (EHR) system:

A robust EHR system ensures complete and accurate medical record management, reducing the likelihood of human error. This technology is particularly helpful in preventing medical billing errors during coding and billing. Automated systems within EHRs can flag inconsistencies and trigger reviews, decreasing claim denials due to clerical mistakes.

2. Use specialized claims scrubbing tools:

Integrating claims scrubbing tools streamlines and accelerates the claims submission process. These tools identify and rectify errors before submission, ensuring cleaner claims. Timely and accurate submissions improve cash flow by minimizing rejections and the need for resubmissions, both of which are costly.

3. Negotiate payer contracts:

Avoid settling for contracts with low reimbursement rates, delayed payments, or excessive administrative burdens. Regularly analyze your payer contracts to secure optimal terms.

Prioritize clear terms that protect your revenue and ensure timely payment. Collaborate with payers to create transparent and mutually beneficial partnerships that improve revenue flow.

4. Conduct regular internal audits:

Proactively identify areas for improvement by analyzing trends in claim denials, discrepancies in charge capture, and issues in insurance verification processes. Regular audits enhance the efficiency of your revenue cycle management. This process allows organizations to address recurring issues that impact revenue streams.

Final Thoughts

Stopping revenue leakage in healthcare isn't just about cost reduction. It's about ensuring healthcare providers have the resources to flourish and deliver exceptional patient care. Eliminating revenue leakage requires a vigilant approach. Embrace technology, invest in staff training, streamline processes, and adopt a proactive mindset.

If you're part of a healthcare admin team and want to know how to manage patient data and other administrative tasks more efficiently, try Magical. Magical is used at more than 50,000 companies like Dignity Health, Optum, and Zoomcare to save 7 hours a week on their repetitive tasks.